Frequently asked

Health Insurance questions

How can our Health Insurance Be So Affordable?

Your premium is based on factors like age, smoking status, location, and overall health—the healthier you are, the lower your cost, similar to a good driver discount for insurance. In the U.S., just 5% of the population accounts for 50% of all healthcare costs. Since our plan isn’t designed for that high-cost group—who typically use the Affordable Care Act (Obamacare) or Medicaid—our members enjoy significantly lower premiums. Because our enrollees are generally healthier, fewer claims are filed, allowing us to keep premiums low while still offering excellent benefits.

Do I Qualify?

This plan may not be the right fit if you have any of the following: Recent heart attack or stroke, Current cancer or a history of cancer within the last five years, Insulin-dependent diabetes, Pregnancy, A disability, COPD, Need for immediate surgery, Age 65 or older. If none of these apply to you, great news! Conditions like high blood pressure, high cholesterol, or other minor health issues won’t prevent you from qualifying for coverage.

Is This Real Health Insurance?

Yes! This is a health indemnity plan that is fully approved and regulated by each state’s Department of Insurance. Unlike Healthcare Sharing Ministries, our plans must comply with state healthcare regulations, ensuring strict adherence to coverage laws wherever they are offered.

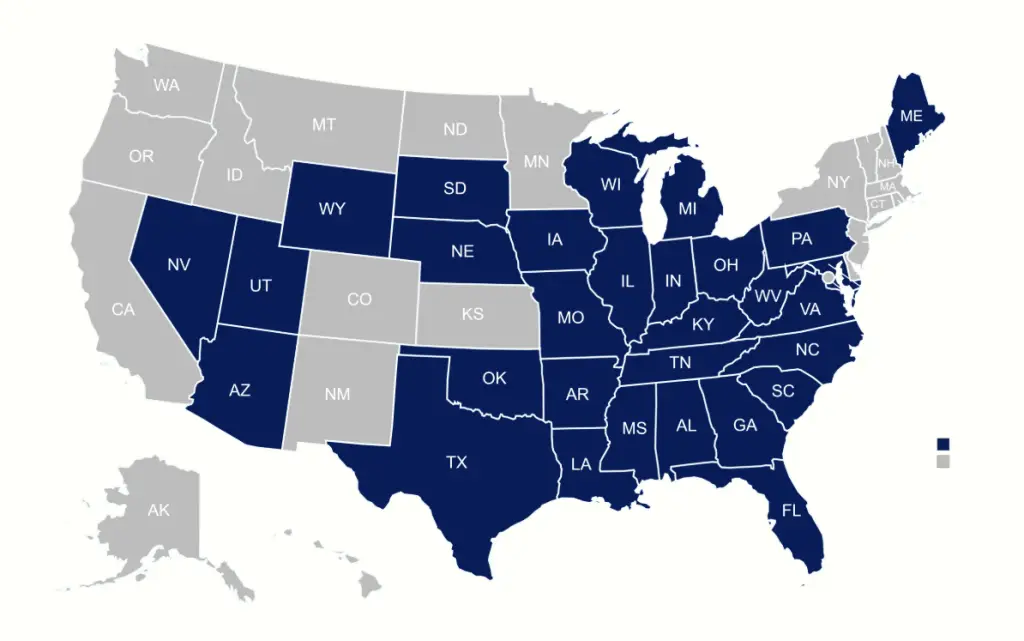

Is This Plan Available in Your State?

Our plans are currently offered in 30 states. Check the coverage map on this page for more details.

Is This a PPO, HMO, or EPO plan?

This is a PPO plan, giving you access to one of the largest provider networks in the country. With over 926,000 healthcare professionals, 140,000 ancillary facilities, 6,100 hospitals, and 1.5 million service locations, nearly 96% of the U.S. population has a provider within 20 miles.

Is My Doctor In-Network?

Most likely, yes! This plan connects you to one of the largest PPO networks, including over 926,000 providers, 140,000 ancillary facilities, 6,100 hospitals, and 1.5 million service locations. Your agent can verify that your doctor is in-network before you apply.

Is There A Max Out-of-Pocket?

Our plans don’t have a traditional out-of-pocket maximum. Instead, you select your annual benefit limit, choosing from $250,000, $500,000, or $1,000,000 in coverage for the year. This allows you to customize your plan to match your healthcare needs and budget.

Will This Provide Enough Coverage for Me?

Once you request a quote, a brief 20-minute call will help us tailor your coverage to fit your healthcare needs and budget. In 2017, only 194 people nationwide filed health insurance claims exceeding $1 million. Most individuals don’t require the unlimited benefits offered by major insurers like Cigna, Blue Cross Blue Shield, Aetna, Humana, and United Healthcare—which is a key reason their premiums are so high.

Do I Have to Pay Upfront and File for Reimbursement?

No. If your doctor and facility are in-network, just present your insurance card as you would with any other plan, and they will handle the claim filing for you. Once the claim is processed, any remaining funds will be sent directly to you as an excess indemnity check.

Is There a Penalty for Not Having ACA Insurance?

No, there’s no penalty for choosing a health indemnity plan instead of an ACA plan.

Can I Offer My Employees a Non-ACA Compliant Plan?

Yes! Businesses with fewer than 50 employees are not required to provide an ACA-compliant plan. If you have 50 or more employees, you can still offer this plan alongside other solutions to ensure compliance with all regulations.

Do I Need to Renew or Re-Qualify Annually?

No, your policy renews automatically each year, regardless of your claims history or changes in health, up to a $5 million limit.