Stop Overpaying For Health Insurance!

Affordable Plans,

Customized To Your Needs

Health insurance that puts your family first

+ up to 48% LOWER premiums

Smart Benefits

With Year-Round Support

Thousands of families, teachers, freelancers, and business owners

are using

this affordable health plan to get better coverage—at a price that makes sense.

Leave your cash at home!

You can enjoy $0 copays when visiting the doctor, specialist, urgent care, and MORE.

Start using benefits like dr visits or urgent care day 1 - with NO deductible.

The only time a deductible applies is if you're in the hospital for more than 24 hours—and even then, you choose the deductible that fits your budget upfront so there are no surprises later.

With access to one of the largest PPO networks in the country our members have no trouble finding doctors - in fact, your doctor is probably already in-network!

Simply show your card and see your doctor - no copay, no hassle.

Real people. Real help.

You’re never alone here.

Our Patient Advocates are experts in medical billing and insurance. From finding doctors to pre-pricing procedures to filing claims and even negotiating surprise bills—they’re just a phone call away.

Flexible plans that put you in control.

Whether you're covering a family, spouse, child, employee, or just yourself, you'll have the flexibility to build a plan around your needs and budget!

Real People. Real Protection.

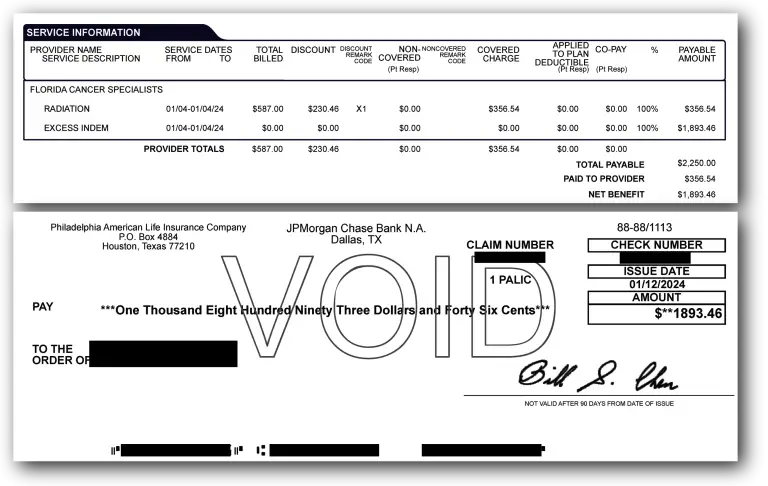

When David* was diagnosed with cancer, he braced for the worst—not just medically, but financially. The treatments came quickly, and so did the bills.

But with the help of his affordable health plan, what followed wasn’t panic—it was relief:

He was able to get the treatment he needed, when he needed it.

Florida Cancer Specialists billed David's plan $356.54 for his treatment. (pictured)

David's plan has $2,250 of coverage for radiation treatment, so his plan paid Florida Cancer Specialists their $356.54 and sent David a check for the remaining $1,893.46 (pictured)

David will get a check like that every day he goes in for treatment, up to his calendar year max, and he is free to spend those checks however he needs too.

I spoke with a licensed agent who showed me how I could stay on my TRS plan for about $19/month—and move my husband and kids to a more affordable private plan.

That one change saved us over $650/month—more than $7,000 a year back in our pocket."

(*Name and identifying details changed for privacy.)

Is this plan right for you?

Find out today by following these steps:

We Handle the System,

So You Can Focus on Healing

Our US-based Patient Advocates are medical billing experts and they are available year-round to take the stress out of care—handling the details so you can focus on getting better.

Patient Advocacy is a voluntary membership and not an insurance product.

Our advocacy team can shop the cost of your health care for you and present fairly-priced options within your benefits.

Never worry about surprise bills again! Our experts can review your bill and negotiate with providers on your behalf.

Our advocacy team handles the claims process for you, so you can get reimbursed sooner.

Just let our team know what kind of doctor you need and they'll do the digging for you to find primary care, specialists, facilities, and more!

Recent Articles

Your Guide to Affordable Health Insurance & Patient Advocacy

Open Enrollment 2025: Rising Costs & Better Options

Discover what Open Enrollment 2025 means for ACA subsidies, Medicaid

Affordable Health Insurance in 2025 | Your Complete Guide

Discover the best affordable health insurance plans in 2025. Compare

Teacher Health Insurance: #1 Strategy to Save Thousands

Discover the #1 teacher health insurance strategy that’s saving educators