Every fall, Americans enter a critical season for healthcare: the health insurance enrollment period. But Open Enrollment 2025, is not “business as usual.”

Two major policy shifts are converging:

Enhanced ACA subsidies are set to expire at the end of 2025.

Medicaid cuts and disenrollments are pushing millions into the ACA marketplace.

Together, these changes mean that millions of households could face higher premiums and fewer benefits, or lose access to affordable care altogether. This guide explains what open enrollment is, who will be most affected by subsidy expirations and Medicaid cuts, and why private alternatives may provide more stability and savings.

Want to get personallized support?

Understanding Open Enrollment in 2025

2025 Dates & Rules

The open enrollment 2025 period for ACA marketplace plans runs from November 1, 2025, through January 15, 2026. (Some states may extend this deadline into late January.) Most individuals and families can only change their health plan during this period.

“Open enrollment is the main opportunity for consumers to compare plans, apply for subsidies, and secure coverage” (KFF).

Key Dates This Year:

September 30, 2025: Congress may act before the end of the fiscal year to extend enhanced subsidies, but this is looking less and less likely.

November 1, 2025: Open Enrollment begins. If subsidies have not been extended, insurers will begin pricing in higher rates. (many insurers have already sent notices of rate increases.)

January 2026: Families will feel the impact in their first bills of the year.

“If enhanced premium tax credits are not extended, millions could see dramatic premium increases in 2025 and beyond” (Commonwealth Fund).

Special Enrollment Periods Explained

If you miss Open Enrollment, you’ll need a special enrollment period (SEP) triggered by a qualifying life event to get marketplace coverage or you can get a private PPO plan (like those offered through American Ally) without a qualifying life event.

SEPs are triggered by qualifying life events such as:

Job loss or reduced hours (losing employer-sponsored insurance).

Marriage or divorce.

Birth or adoption of a child.

Moving to a new state or service area.

In 2025, Medicaid cuts are creating a new wave of SEP eligibility. Millions of families are losing Medicaid as states resume eligibility checks.

“Approximately 25 million people lost Medicaid benefits during this redetermination process.”(JAMA) Forcing many to search for health plans at significantly higher costs.

How Subsidies and Medicaid Cuts Are Changing the Landscape

For the past several years, enhanced subsidies have kept ACA premiums lower for many families. But these subsidies are projected to expire at the end of 2025.

Many marketplaces, regulators, and insurers are warning enrollees now because 2026, rate filings often assume no extension. Some state notices and press reports are already flagging sharp increases if Congress doesn’t act.

“Statewide average proposed increases, where released by the state, all show double-digit rate hikes, ranging from 10% in Oregon to 24% in Rhode Island.” (Center On Health Insurance Reforms)

At the same time, Medicaid disenrollments are forcing millions to seek coverage else ware.

Subsidized ACA Enrollees at Risk

Since 2021, enhanced subsidies under the American Rescue Plan and Inflation Reduction Act have lowered premiums for millions of marketplace enrollees.

With these subsidies are set to expire in 2025, analysts project that net premiums (what people actually pay after subsidies) could rise by an average of 75% in 2026.

In some states, monthly payments could double or more, especially for those in lower-income brackets.

For many middle-class families, the subsidy cliff will mean a tough choice between paying inflated premiums or going uninsured.

Millions Losing Medicaid Coverage in 2025

The Medicaid “unwinding” process that began in 2023 continues into 2025, with millions losing eligibility. Children have been disproportionately affected.

This shift is particularly destabilizing for low-income families who relied on Medicaid’s comprehensive benefits.

Are You At Risk Of Losing Subsidies?

ACA subsidies are based on income, measured against the Federal Poverty Level (FPL). In 2025, the subsidy cutoff is 400% of FPL. If your annual income is at or beyond the cutoff, you could be at risk.

| Household Size | 100% FPL | 400% FPL (Subsidy Cutoff) |

|---|---|---|

| Individual | $15,650 | $62,600 |

| Family of 2 | $21,150 | $84,600 |

| Family of 3 | $26,650 | $106,600 |

| Family of 4 | $32,150 | $128,600 |

Source: HHS 2025 Poverty Guidelines.

Even families just under the cutoff often feel squeezed. Rising premiums, inflation, and deductibles compound the problem. Middle-income families face higher costs and limited protection, as subsidies taper and deductibles rise. (Forbes: Healthcare Costs Are Devouring The Earnings Of Middle-Class Families).

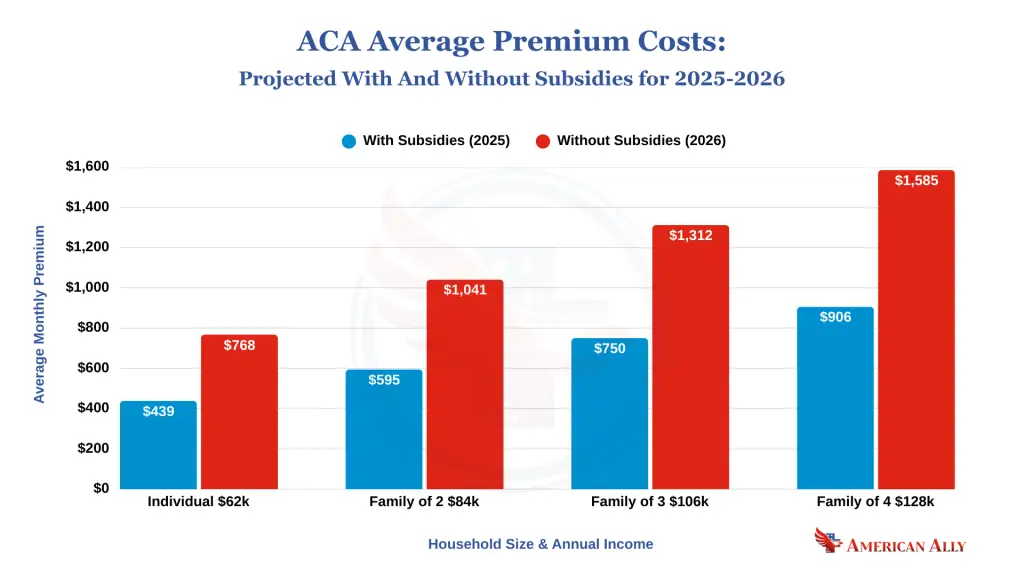

Projected Premium Increases if Subsidies Expire

Our analysis shows just how steep premiums could climb if enhanced subsidies expire at the end of 2025.

For example, an individual earning $62,000 would see monthly premiums jump from about $439 to $768—an increase of nearly $4,000 per year. A family of four earning $128,000 would pay $679 more each month, or more than $8,100 annually.

This aligns with projections, from multiple sources, that estimate, average premiums could rise by about 75% in 2026, if enhanced subsidies are not extended.

The Real Costs of Coverage Through the Marketplace

Subsidies reduce premiums, but they don’t solve deeper affordability issues.

Gaps in Coverage Leave Families Exposed

Even with ACA protections, many households still face costly coverage gaps. For those who lose job-based insurance mid-year, COBRA is often the only bridge but at a steep price…

COBRA Premiums: In 2024, employer coverage reached nearly $25,572 per year for families, and COBRA only allows families to keep their plan and pay the full monthly premium (without employer contributions).

Uninsured Risks: A three-day hospital stay costs $30,000 on average.

Why Subsidies Don’t Always Equal Savings

ACA subsidies reduce premiums, but they don’t eliminate all costs:

High Deductibles: Average Bronze Plan Deductible Projected To Be $7,186 in 2025.

Narrow networks (like HMO’s & EPO’s) can exclude top hospitals and specialists.

Claim denials limit access to certain treatments.

In practice, “affordable coverage” can mean premiums you can pay but benefits you can’t use.

Affordable Alternatives Available Year-Round

American Ally Private PPO Plans

Unlike ACA marketplace options, American Ally private PPO plans are available year-round—no need to wait for open enrollment. This makes them especially valuable for families who may lose Medicaid coverage mid-year or for those whose subsidies expire.

Key features include:

$0 copays for doctor visits, specialists, urgent care, and emergency room visits.

$0 outpatient deductibles, allowing benefits to start immediately.

Up to 20 doctor visits per person, per year, including chiropractic care.

Nationwide PPO network with no out-of-network penalties.

24/7 Telehealth included.

Cash-back when your provider bills less than your plan benefits.

I spoke with a licensed agent who showed me how I could stay on my TRS plan for about $19/month—and move my husband and kids to a more affordable private plan.

That one change saved us over $650/month—more than $7,000 a year back in our pocket."

(*Name and identifying details changed for privacy.)

How American Ally Helps Families Save

Understanding the types of coverage available is only part of the equation. For many families, the real challenge is navigating those choices and finding a plan that not only fits their budget but also works when they need care. This is where American Ally steps in.

We believe that Americans deserve affordable healthcare, and our team is dedicated to making that possible every day. We do this in two key ways:

Lowering monthly costs by connecting people with plans that are significantly less expensive than Marketplace or COBRA options.

Providing advocacy services that reduce bills and bring clarity to a system that often feels overwhelming.

Real People. Real Health Insurance Savings.

Travel Nurse (illustration based on a real case): She had been paying $302 per month for a US Health plan but switched to American Ally for just $192 per month. Not only did she save over $100 monthly, but she also gained access to a nationwide PPO network—crucial for a nurse traveling between states.

Retired Couple: After retirement, they were shocked when COBRA premiums came in at $1,700+ per month. They moved to an American Ally plan for just $745 per month, freeing up more than $11,000 annually to use for living expenses instead of insurance.

Self-Employed & Uninsured: Anita had gone uninsured for more than three years because traditional plans were too costly. American Ally helped her secure a PPO plan for $265 per month, finally putting affordable and usable coverage within reach.

These are not isolated stories. Every day, our team helps individuals, families, freelancers, retirees, and small business owners find solutions that put hundreds back in their pockets.

Advocacy services: pre pricing and bill negotiation

Affordability doesn’t end when the premium is paid. For many Americans, the real sticker shock comes after care is delivered—when the medical bill arrives.

One lab test may cost $900 at a hospital but only $48 at a nearby clinic (KFF).

Research shows 80% of medical bills contain errors, often inflating charges by thousands (Sycamore Institute).

That’s why American Ally provides:

Procedure pre-pricing: so you know upfront what a visit, lab, or surgery should cost.

Post-bill negotiation: to challenge inflated or incorrect charges and reduce medical debt risks.

In short: American Ally does more than sell insurance. We partner with families to make sure coverage works in real life, not just on paper.

Open Enrollment 2025 comes at a crossroads for American healthcare...

If Congress fails to extend subsidies by Sept 30, 2025, millions will face dramatic premium increases starting in January 2026. At the same time, Medicaid disenrollments are stripping coverage from children and parents across the nation.

For too many, this will mean choosing between healthcare and basic necessities.

But families are not without options. American Ally private PPO plans provide year-round enrollment, $0 copays, no outpatient deductibles, and nationwide PPO network access. With additional advocacy services like pre-pricing and bill negotiation, these plans ensure benefits work in practice and not just on paper.

At stake are not just numbers on a page, but real families deciding whether they can afford to see a doctor, fill a prescription, or stay out of debt. With American Ally, you don’t have to face those choices alone.

Americans deserve affordable healthcare. And with American Ally, you have a healthcare ally for every step of the journey.

See How Much You Could Save:

FAQs on Open Enrollment and Affordable Coverage

When Is Open Enrollment for 2025?

The health insurance enrollment period for 2025 runs from November 1, 2025, through January 15, 2026, for most states. Some states that run their own marketplaces extend enrollment into late January. Always confirm with your state exchange. Missing the deadline means you’ll need a special enrollment period or consider a private plan like American Ally, which can be joined anytime.

Can You Be Denied Obamacare?

No. Under ACA enrollment rules, marketplace plans are guaranteed issue—you cannot be denied for pre-existing conditions. However, “guaranteed coverage” doesn’t guarantee affordable access. Families often struggle with high deductibles, limited doctor networks, and surprise out-of-pocket costs even when insured.

What Is the Highest Income to Qualify for Subsidies in 2025?

Premium subsidies typically phase out at about 400% of the Federal Poverty Level (FPL). That’s roughly $62,600 for an individual and $124,800 for a family of four in 2025. If subsidies expire, middle-income individuals and families above this line could see premium hikes of thousands of dollars (Urban Institute).

What Happens if ACA Subsidies Expire in 2025?

If Congress fails to extend the pandemic-era subsidy enhancements, millions of Americans would likely face premium spikes of about $1,000–$3,000 annually depending on household size and location (Commonwealth Fund). For millions, this could mean being priced out of ACA coverage entirely.

How Do Medicaid Cuts Affect Children and Families?

Since 2023, Medicaid redeterminations have disenrolled more than 4 million children nationwide. Families losing Medicaid often face higher premiums and narrower provider networks on ACA plans. Private alternatives, like American Ally, can provide continuous PPO coverage without sudden disruptions.

Are Marketplace Plans the Only Option During Open Enrollment?

No. While ACA Marketplace plans may feel like the default, private PPO plans, like those from American Ally, can be joined year-round. These often include $0 copays, $0 outpatient deductibles, and broad PPO provider networks, making them a strong alternative for those losing subsidies or Medicaid.

What If I Miss the Open Enrollment Deadline?

If you miss open enrollment, you can either:

- Get a private PPO plan (American Ally’s private plan allows you to enroll year-round without a qualifying life event)

- You’ll need a special enrollment period triggered by a qualifying life event (job loss, marriage, birth, or Medicaid disenrollment). Otherwise, you may remain uninsured until the next year.

What Is a Special Enrollment Period and How Do I Qualify?

A special enrollment period (SEP) allows you to enroll outside of standard dates if you have a qualifying event: loss of employer coverage, moving, marriage, divorce, birth/adoption, or Medicaid loss. With Medicaid disenrollments surging in 2025, millions qualify for SEPs, but many find Marketplace options unaffordable.

How Much Are ACA Deductibles in 2025?

Bronze and Silver-level ACA plans in 2025, often carry deductibles of $5,000-$7,500before coverage begins (Commonwealth Fund). This means families may pay thousands out-of-pocket before their insurance even applies.

Are Private Health Insurance Plans ACA Compliant?

Most private PPO-style plans, including those offered by American Ally, are not ACA-compliant. This means they are exempt from ACA rules but can still provide substantial coverage at lower costs. For many families, these plans provide better everyday benefits than Marketplace plans with high deductibles, restrictive networks, and copays or coinsurance.

Do American Ally Plans Cover Prescriptions and Preventative Care?

Yes. American Ally plans include generic and brand-name prescription benefits, as well as preventative care services like mammograms, colonoscopies, and annual checkups. These benefits are structured to be affordable and usable, unlike many ACA plans that require meeting high deductibles first.

What Alternatives Exist if I Don’t Qualify for Subsidies?

If your household income is too high for ACA subsidies, private health plans are often the most affordable alternative. American Ally plans feature predictable benefits, low monthly costs, and nationwide PPO access—making them an option for small business owners, freelancers, and dual-income families who don’t qualify for assistance.

Who should consider private alternatives?

Families losing Medicaid.

Households above 400% Federal Poverty Line.

Middle-income families squeezed by rising costs.

Anyone priced out of COBRA.

Freelancers, small business owners, and self-employed workers.